Adam Smith, Alexis de Tocqueville, and Alexander Hamilton on Digital Money

From classical economics to digital transformation

The digital age is profoundly transforming money. The rise of cryptocurrencies, the emergence of stablecoins, and the exploration of central bank digital currencies (CBDCs) are reshaping the way we think about and interact with currency. Unfortunately, most of the current discussions surrounding digital money focus on details regarding the technological, legal, and economic challenges associated with their implementation. People rarely ask if digital currencies are actually needed, or how we should design them so that they align with their specific political systems. Given the problem’s complexity, and the high knowledge threshold required for speaking authoritatively about digital currencies, such discussions should be fostered at the global level, so that policy makers and societies can make informed decisions, on topics that will affect future generations. This is why considering the perspectives of the intellectual giants who laid the foundation for our understanding of economics and governance is vital.

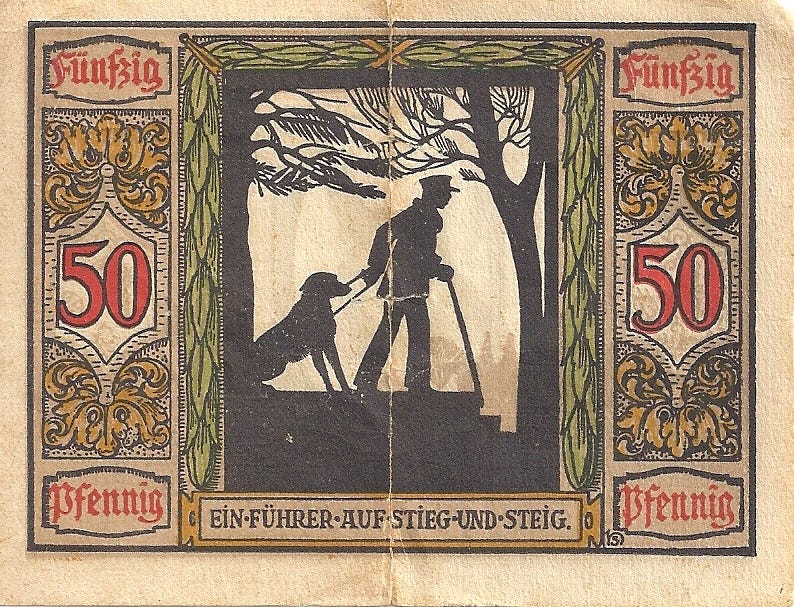

A German “emergency currency” note printed by Oldenburg when the central government couldn’t provide adequate paper supplies money after WWI. Lee Cannon/Flickr.

Adam Smith, Alexis de Tocqueville, and Alexander Hamilton’s influential ideas continue to resonate today. Each contributed unique insights into economics, politics, and democracy. They lived in different eras and encountered distinct monetary systems, but their thoughts on money and governance provide valuable perspectives that can enrich our understanding of digital money.

This article will unveil Adam Smith, Alexis de Tocqueville, and Alexander Hamilton’s thoughts on digital money. Their classical perspectives are sound guidance for the challenges and opportunities digital currencies create. Examining their ideas through the lens of contemporary digital transformation can give insight into the policy implications, for the financial sector, cross-border payments, and the particular features digital money and CBDCs should have to align with democratic principles.

Economic and political thinkers have long grappled with money’s complexities and its effect on society. By delving into these thinkers’ perspectives we will examine the ongoing discourse surrounding digital money. By bridging the gap between classical economics and the digital era, we can navigate this evolving landscape and forge a path that upholds democratic principles while embracing digital currency’s potential.

Adam Smith on the role of currency in economic transactions

Adam Smith championed the virtues of free markets, limited government, and currency’s role in economic transactions. He believed that individuals pursuing their self-interest within a competitive marketplace would lead to optimal resource allocation and overall societal prosperity. Smith argued that free markets, unencumbered by excessive government regulation, create economic efficiency. When individuals’ own preferences and judgements inform their free exchange of goods and services, market forces of supply and demand create efficient resource allocation. This efficiency allows for economic growth and the maximization of societal wealth.

Exhibit at the Institut Valencià d'Art Modern. 16:9clue/Flickr.

Smith advocated for limited government intervention, but recognized that some government intervention was necessary for providing public goods, enforcing contracts, and maintaining the rule of law. But he cautioned against excessive interference in economic affairs, as he believed that central planning and excess regulation would limit innovation, competition, and distort markets overall.

Currency played a crucial role in Smith’s economic framework. Throughout The Wealth of Nations, Smith discusses the importance of stable and reliable currency as the medium of exchange, store of value, and unit of account. He argued that a trust and confidence based monetary system facilitated economic transactions and fostered economic growth, while still cautioning against arbitrary government currency manipulation, such as excessive printing of money, because it could lead to inflation and disrupt economic stability.

Alexis de Tocqueville on the delicate balance between centralized power and local autonomy

Alexis de Tocqueville was deeply insightful about democratic society dynamics and the delicate balance between centralized power and individual liberty. Considering the potential risks to democratic principles in the digital money era, Tocqueville’s view on democracy, individual liberty, and central government are highly relevant.

Tocqueville celebrated democracy as a system that upholds the principles of equality and individual liberty. He recognized the power of democratic participation and citizens’ ability to shape their own destinies. He did not explicitly mention privacy, but his strong support for individual liberty and limiting central power indicates that today he would likely champion privacy, defined as a fundamental component of liberty and personal rights. It is very likely that he would warn against the invasive encroachment on privacy, as its loss could lead to the erosion of personal freedoms and the potential for abusing power.

He also advocated for local autonomy, self-governance, and a system of check and balances. Tocqueville was concerned that a centralized entity’s concentrated power and decision-making authority would undermine individuals’ autonomy and self-determination, potentially threatening society’s democratic fabric.

Alexander Hamilton on governance and financial systems

Alexander Hamilton advocated for a strong, central government, capable of addressing national issues and promoting economic development. He also supported the establishment of a national bank to manage the country’s financial affairs.

A detail of a bank note. RJP/Flickr.

Hamilton recognized that a strong government could provide stability, foster economic growth, and bolster the nation’s creditworthiness. In the “Report on the National Bank” (1790), Hamilton argued that a central bank was necessary to promote economic stability and facilitate commerce. The central bank would manage the nation’s currency, provide a stable medium of exchange, and regulate the banking system. In this role, the central bank would help control the money supply, prevent inflation, and establish a uniform and reliable currency.

Furthermore, in Federalist No. 35, Hamilton discussed a national bank’s importance in facilitating credit and supporting economic growth. Hamilton also believed in a well-regulated financial system that would facilitate commerce. His support for a banking system is implicit recognition that ensuring access to financial services for a wide range of individuals is important.

Comparing Smith, de Tocqueville, and Hamilton on digital money

If Smith, de Tocqueville, and Hamilton were writing today, they would likely engage publicly on digital money. Their perspectives, however, would likely differ.

For Adam Smith, a stable and reliable medium of exchange for facilitating economic transactions was vital. He believed that money should have certain qualities, such as divisibility, durability, and widespread acceptance, to serve as an effective means of exchange. He might have welcomed the efficiency, speed, and convenience in conducting transactions that digital money offers.

An illustration by Arthur Hughes in Sing-Song, A Nursery Rhyme Book, MacMillan and Co., 1907. TheCMN/Flickr.

Alexis de Tocqueville valued individual liberty and warned against centralized power’s dangers. He emphasized local autonomy and self-governance as essential components of democratic societies. With this in mind, Tocqueville would likely be concerned that concentration of control would accompany digital currencies, regardless of their specific form.

Alexander Hamilton, like Smith, would likely appreciate the potential for improved efficiency. Conducting transactions quickly and securely aligns with his vision of a well-functioning financial system. Hamilton would likely see digital money’s potential to streamline payment processes, reduce transaction costs, and facilitate international transactions as a means to enhance economic efficiency and promote commercial activity. He would also appreciate digital money’s potential for financial inclusion, especially among the underserved populations. On the other hand, he would stress the establishment of a secure and reliable digital currency system, to create stability and attract investment. He would likely champion a robust regulatory framework to mitigate risks associated with digital money, such as fraud, money laundering, market manipulation, and cybersecurity.

Smith might have appreciated cryptocurrencies’ decentralized nature, which are based on blockchain technology and operate without central authority. This decentralization aligns with his appreciation of free markets and limited government intervention. He might, however, have also been concerned that their volatility and unregulated nature could hinder their stability as a medium of exchange.

Similarly to Smith, Alexis de Tocqueville might have appreciated the potential cryptocurrencies have for decentralized transactions and their ability to operate outside traditional financial institutions. Blockchain based cryptocurrencies could align with Tocqueville’s belief in individual liberty and diffused power. But he might have also worried that the lack of regulation might lead to the spike in illegal activities often associated with cryptocurrencies.

Alexander Hamilton’s views would have been likely mixed. Hamilton is known for supporting economic progress and innovation; he would have viewed cryptocurrencies as innovation’s product and recognized their potential for revolutionizing the financial landscape. On the other hand, like Tocqueville, he would have expressed concerns about volatility, lack of regulation, and potential for illicit activities.

Smith, Tocqueville, and Hamilton’s perceptions of stablecoins would also differ. Stablecoins aim to maintain a stable value by pegging to a reserve asset. Smith might have viewed their potential to mitigate volatility concerns favorably, as their stable value could provide a more reliable medium of exchange.

Similarly, Tocqueville might have seen stablecoins as digital currency in a more reliable and controlled form that potentially mitigates the volatility risk. Stability and predictability would be important to him, as both safeguard individual liberties and protect against economic risks. He might, however, have questioned the entities managing the reserve assets and their potential for centralized control.

Bank notes line the ceiling of the England’s tiniest pub, The Nutshell, in Bury Saint Edmonds. Soapbeard/Flickr.

For Alexander Hamilton, stablecoins’ potential stability and predictability would be attractive. Their ability to facilitate efficient transactions and financial inclusion could also align with his principles of economic growth and credit access.

Finally, Smith might have seen CBDCs as having potential efficiency and monetary control advantages. He might also appreciate the streamlined digital transactions and central banks’ ability to monitor and manage the money supply more effectively, as it would ensure money’s consistent value. That said, he might caution against the increased government surveillance and concentration of power that CBDCs could enable.

Alexis de Tocqueville, in turn, would likely view skeptically centralized power’s concentration of control and potential expansion that could accompany CBDCs, and be cautious about CBDCs’ implications for privacy, individual liberties, and the potential erosion of democratic principles. Tocqueville valued local autonomy and self-governance and CBDCs might conflict with these principles if programmed inappropriately.

Opposite to that, Alexander Hamilton, a strong supporter of central government and stable financial systems, might view CBDCs favorably, as a means to enhance financial stability, promote efficient transactions, and facilitate better monetary policy.

Embracing the Future: Implications of Digital Money for Society and Governance

As the potential views of Smith, Tocqueville, and Hamilton show, digital money represents a significant transformation in the way we conduct financial transactions. From Adam Smith’s lens emerges efficiency and control over the money supply, but he also warns against the risks of increased government surveillance. Alexis de Tocqueville cautions against the concentration of power and the erosion of democratic principles, and emphasizes the need for checks and balances. Alexander Hamilton’s support for stability and strong governance aligns with the digital money’s potential advantages in terms of improved efficiency, financial inclusion, and economic growth. Concerns over privacy, surveillance, and the need for proper regulation arise across all perspectives.

Youth and age depicted on a 1941 Hungarian bank note. Seriykotik1970/Flickr.

The implications for policymakers, regulators, and society as they navigate the digital transformation of money while upholding democratic principles are profound. Policymakers must strike a delicate balance between harnessing digital money’s benefits while ensuring individual liberties are safeguarded against excessive control and encroachment. Regulators face the challenge of creating a regulatory framework that fosters innovation, protects consumers, and maintains financial stability in the digital realm. Society at large must actively engage in shaping digital money’s future, by advocating for transparent governance, privacy protections, and democratic values’ preservation. We should embrace this digital future with the wisdom of historical figures as our guide, and chart a course that promotes and safeguards our democratic societies’ core principles.

Conclusions

Adam Smith, Alexis de Tocqueville, and Alexander Hamilton’s perspectives on digital money are powerful reminders of the importance of historical context in shaping contemporary debates and decision-making processes. Their thoughts offer valuable insights into the potential benefits and concerns associated with money’s digital transformation. From their wisdom, we gain insight into the implications for society, governance, and democratic principles in this digital age. As we navigate digital money’s complexities, it is crucial that we continue to seek a multidisciplinary understanding that integrates economic, legal, technological and socio-political perspectives. Only through this holistic approach, so close to Smith, Tocqueville, and Hamilton’s own methods, can we effectively address the challenges and seize the opportunities digital money presents and ensure its alignment with our core principles.