Cryptocurrencies: From Roaring Lion To Gentle House Cat

The broken promise of financial transformation

A few years ago, before the pandemic struck the world, the cryptocurrency sector conceived a grand vision—a world of cheap, more efficient, and accessible financial transactions. Alongside this vision came additional, compelling arguments of enhanced privacy, the democratization of money, financial inclusion for the underserved, and a revolution in finance free from central bank clutches.

Cryptocurrencies emerged as a roaring lion, ready to challenge the financial sector’s expensive and sometimes obsolete services by offering direct, peer-to-peer transactions without intermediaries. But as time passed and the cryptocurrency sector navigated setbacks, including the FTX exchange’s recent epic fall, the global community faced a disheartening reality: The once roaring lion, challenging the financial sector and central banks, now resembles a gentle house cat, subdued and compliant to regulators and financial markets.

Bankers and coins. Russell Harry Lee/Flickr.

The broken promises loom large as the cryptocurrency sector grapples with providing true financial inclusion, ensuring cost efficiency, understanding central banks' role, securing financial stability, and, more recently, complying with regulation. The whole sector brought important financial technology innovation, but its role and future are still uncertain.

The illusion of cost-efficiency

Cryptocurrencies promise efficient global fund-transfers with minimal costs, thanks to blockchain technology handling transactions without intermediaries. Transaction fees and settlement times are typically low, with costs ranging from a cent to a few dollars, and settlement taking minutes, starkly contrasting the days and higher costs associated with traditional banking transactions.

Transaction fees in the crypto world, however, fluctuate based on network usage, causing spikes due to energy-intensive proof-of-work mechanisms. Bitcoin's ensuing scalability issues led to increased fees and delays. These limitations challenge the initial promise of cost-efficiency as users need help accurately estimating costs. Additionally, cryptocurrencies may involve additional expenses like exchange fees or conversion fees, making cost and time efficiency uncertain and the promise of cost-efficiency elusive.

A dream of financial inclusion

According to the World Bank and World Economic Forum[1], nearly two billion people remain unbanked. The cryptocurrency sector has often presented this information as a target market for cryptocurrencies, which are unregulated and accessible and could allow for greater financial inclusion.

By analyzing available data, however, one can see a close correlation between unbanked and underdeveloped regions and unbanked and older generations. Available data indicates that one can’t just offer access to digital money to solve the financial-inclusion challenge, but rather must ensure that countries have the necessary digital infrastructure, legislation and cybersecurity-frameworks to ensure public trust.

Graffiti by the sea in Brighton England. Tristan Roddis/Flickr.

Moreover, a robust financial literacy program should be developed and implemented to encourage older people to use cryptocurrencies. It is also critical to point out that for non-technical users, it is challenging to create and secure digital wallets or manage private keys, mainly because many cryptocurrency platforms or exchanges need more intuitive, user-friendly interfaces. Despite these shortcomings, cryptocurrencies have successfully lowered the rate of unbanked across the young populations in developing regions.

Challenging central banks’ role

Cryptocurrencies were not meant to be regulated by any central government authority, given the core function of distributed ledger technology, which allows the establishment of decentralized transactions. Many cryptocurrency enthusiasts envisioned a world without central banks, but cryptocurrency companies could not supplant central banking’s vital functions, such as managing monetary policy, maintaining financial stability, addressing inflation, or acting as a lender of last resort. Crypto businesses need more mechanisms critical for fighting inflation, managing reserves, or responding to economic challenges.

Nevertheless, cryptocurrencies’ key benefits–such as fast and borderless transactions–could bolster money markets if they find a way to cooperate (rather than compete) with the central banks. Such cooperation could happen if cryptocurrencies function as complementary systems within the financial sector landscape, adhere to regulatory frameworks, and explore interoperability solutions to facilitate seamless transfer and conversion between digital and traditional fiat currencies.

Solving the privacy puzzle

Many cryptocurrency users embarked on the digital currency journey, knowing that their transactions remain private and that governments can not access the digital ledgers. This initial promise of pseudonymity allowed users to conduct transactions without revealing their identities.

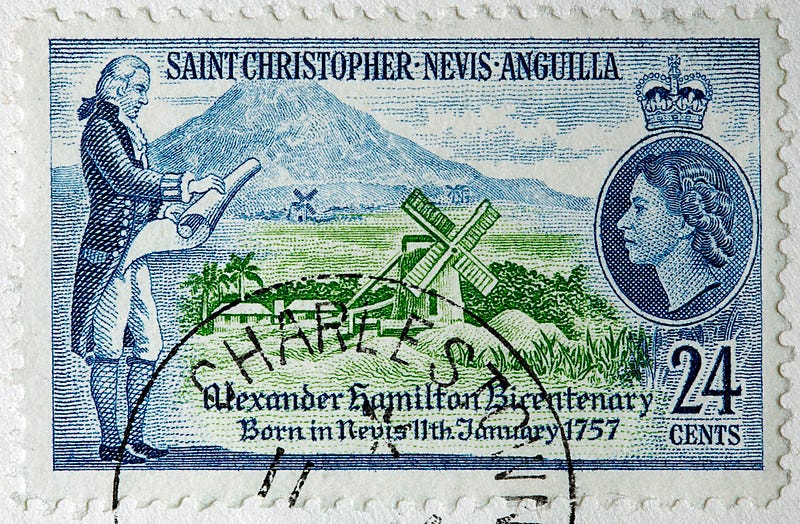

Alexander Hamilton featured on a St. Christopher bank note on the 200th anniversary of his birth. Mark Morgan/Flickr.

This anonymity is vital to preserving privacy, a cornerstone of fundamental human freedoms in democratic societies, but in some instances, cryptocurrencies were used for fraudulent transactions, for illegal activities, and to bypass international sanctions. These sorts of frauds triggered a public discussion on the need for the cryptocurrency sector to comply with anti-money laundering (A.M.L.) and know-your-customer (K.Y.C.) regulations. As a result, cryptocurrency exchanges and service providers operating in advanced economies and many emerging markets implemented stricter identity verification and transaction monitoring mechanisms. These measures reduced illicit activities, but they also raised concerns about the erosion of privacy and opened the doors for data misuse. Striking the right balance between privacy and compliance remains an ongoing challenge for the sector.

Conclusions

Cryptocurrencies have been crucial in bringing new technologies to financial markets. If the world adopts distributed ledger technology in the money markets, we will witness the biggest monetary revolution of our time. The cryptocurrency sector has not, however, delivered on promises of democratizing money, diminishing the role of central banks, delivering robust privacy, or even addressing financial inclusion.

The ambition to create decentralized monetary systems has proven complex; central banks play a crucial role in regulating economies, implementing monetary policies, and ensuring financial stability. Moreover, concerns over privacy and traceability have required the sector to adapt to regulatory frameworks, compromising some of the initial promises of anonymity.

As the crypto sector evolves, finding a balance between innovation, compliance and stability will be essential for its future development. A democratized and efficient financial system will require collaboration and adaptation between all the players: cryptocurrencies, central banks and regulatory bodies alike. There’s certainly great potential, but realizing it takes great humility; crypto simply cannot do it alone.

Piotr Trabinski is a Senior Fellow at the Common Sense Society and a former IMF executive director.